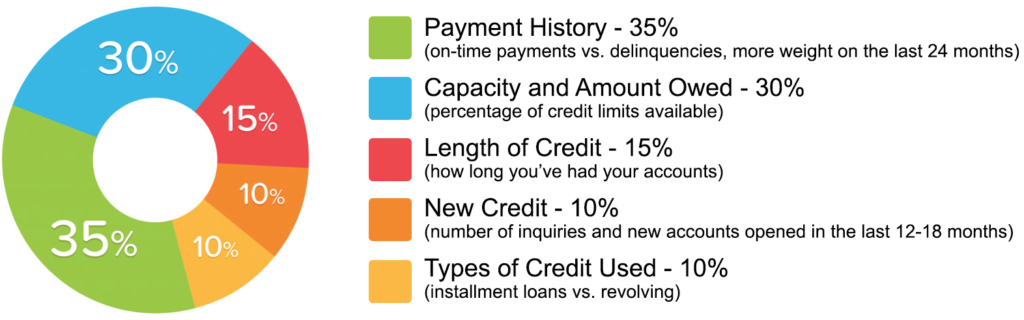

Pay all of your bills on time, every time. This includes your utility bills, mortgage and auto payments, and all of your revolving lines of credit like credit cards. Check your credit report at least once a year. You can find out how to challenge bad information on your credit report here.

Never charge more than 30% of the available balance on any of your credit cards. Banks like to see a nice record of on-time payments, and several credit cards that are not maxed-out. If you are carrying high balances on your credit cards, then make paying them down below 30% a priority. Do use your credit cards – Many people who make mistakes with their credit believe that the best way to fix things is to never use credit again. If you are afraid that you cannot handle your credit cards correctly then the best policy is probably this one: Run only your utility bills on your credit cards each month, and then pay the balance in full by the due date. This ensures that your utility bills get paid on time automatically, and as long as you keep the habit of paying off your credit card balance each month your score will continue to go up. Leave the credit cards locked in a safe or drawer at home.

Keep your accounts open as long as possible – Even if you are no longer charging on the card. The best policy is to keep those unused accounts open, blow the dust off your card every few months to make a small purchase, then pay it off. How long each of your accounts have been active is a major factor in your credit score.

Remember that this all takes time – Following the above steps consistently over a long period of time will increase your credit score and allow you to qualify for better loans and lower interest rates. Repairing your credit score does not happen overnight, so if you do these things for a few months and do not see a large increase in your score, do not give up. They are all habits that you will want to maintain throughout your life, as they will help you to keep your finances and lines of credit under control.

Prior to starting credit education and document processing services, you will sign a client agreement along with the following: